Most business-to-business (B2B) organizations take orders over the phone, by email, or in some cases, still by fax. When you compare this to how orders are taken in the B2C world, the B2B space is lagging when it comes to digital ordering and payments. When a B2B business does not allow for self-serve/online ordering, cash flow can be negatively affected because payments are often delayed one to three months, and customer satisfaction can also be negatively affected. Today, B2B customers expect real-time transactions and ease of placing orders like they do in the B2C world. Forrester Research said 93 percent of wholesales buyers prefer to buy online. Are you keeping up with the demands of your buyers?

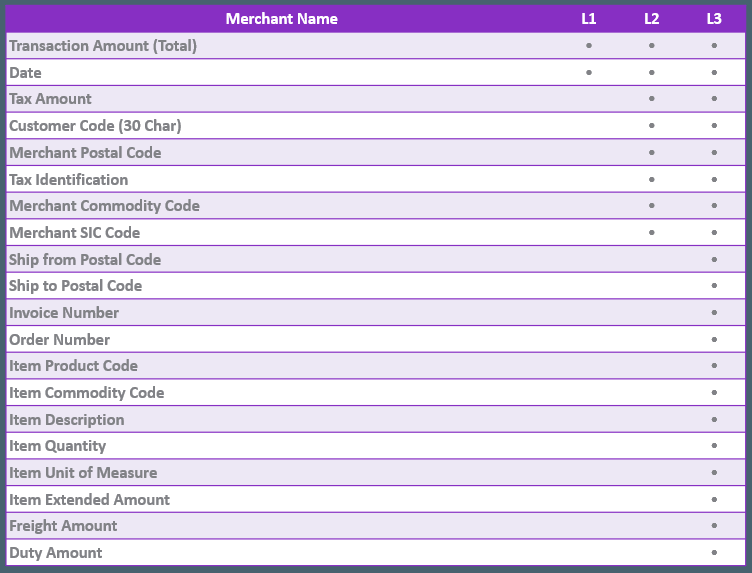

Many believe that B2B transactions are too complex and too expensive to automate, but they can be more affordable than you might think due to benefits of Level 3 credit card processing when you go with a payment processor that offers Interchange Plus Pricing. Level 3 rates are not available for flat rate or tiered rate credit card pricing plans. Level 3 processing requires you be designated as a B2B merchant with the credit card networks and requires you to submit additional data points with each B2B transaction to be eligible for the lower rates. Mastercard and Visa are two card networks that offer Level 3 rates, and only corporate or purchasing cards (P-Cards) are accepted for Level 3 transactions that provide the lower credit card transaction fees. See chart below on additional data points required for Level 3 credit card processing:

It is easy to pass Level 3 data when you work with a processor that offers integrated payment processing for Acumatica and Magento. This is because the integration will pass along the additional data fields automatically. Another benefit of using a payment provider that integrates with both your ERP and eCommerce site is that you will be provided with one redundant gateway, which will minimize your transaction costs, and provide you the ability to access the same credit card token ID, which makes it easier to issue refunds, voids, and process future payments.

By accepting digital payments for your B2B business, you can save time and money. According to a Deloitte 2015 study, B2B cards offer tremendous benefits for B2B Businesses. Key benefits include:

- Reduced processing time

- Reduction in approvals needed

- Reduced admin cost

- Improved visibility and data reporting

- Improved supplier relations

- Improved cash flow

Repay (previously known as APS Payments) can help you with B2B Payments for Acumatica and Magento

Repay is an all-in-one processer that offers flexible and integrated payments solutions for every business. We are a 100% PCI-DSS compliant solution and are trusted by thousands of merchants daily to process payments. We work diligently to provide our merchants the lowest credit card processing rates leveraging our industry expertise and help B2B businesses reduce risks. Repay is seamlessly integrated with Acumatica and Magento, as well as hundreds of other ERP, eCommerce, POS, and Mobile applications. Watch the Acumatica and Magento B2B Payments webinar recording and learn how B2B Payments can save your business time and money!