In today’s rapidly evolving business landscape, Acumatica users are facing growing complexities in managing data and decision-making processes. Traditional Financial Planning & Analysis (FP&A) has been foundational, but to stay competitive, many organizations are embracing Extended Financial Planning & Analysis (xFP&A), also known as xFP&A. This advanced framework centralizes and expands the role of finance in performance management, helping organizations make faster, more strategic decisions.

But what exactly is xFP&A, and how does it differ from traditional FP&A? At its core, xFP&A leverages the finance team’s capabilities, placing them at the helm of broader organizational planning and analysis efforts. This holistic approach integrates data and planning across multiple departments, streamlining decision-making processes and optimizing company-wide performance.

The Benefits of Embracing xFP&A

One of the primary advantages of xFP&A is its ability to replace manual processes with automated systems that unify data from different sources. Instead of relying on disparate software solutions or spreadsheets that can become cumbersome, xFP&A solutions enable real-time decision-making through data consolidation and process automation.

Here’s how adopting xFP&A can revolutionize your organization:

- Efficient Resource Allocation: By consolidating data across departments, businesses can better understand resource needs and allocate budgets more effectively.

- Streamlined Reporting: Automated financial and operational reports offer up-to-date insights, reducing time spent on manual tasks and freeing up finance teams to focus on more strategic objectives.

- Improved Forecasting: With scenario planning tools, finance teams can predict trends and market movements, providing the agility needed to outperform competitors and adapt to changes.

These all-in-one xFP&A solutions create more than just financial efficiencies—they empower finance leaders to play an active role in shaping the company’s future, moving beyond number-crunching to becoming key decision-makers in the organization.

Maximizing the Role of Finance Leaders

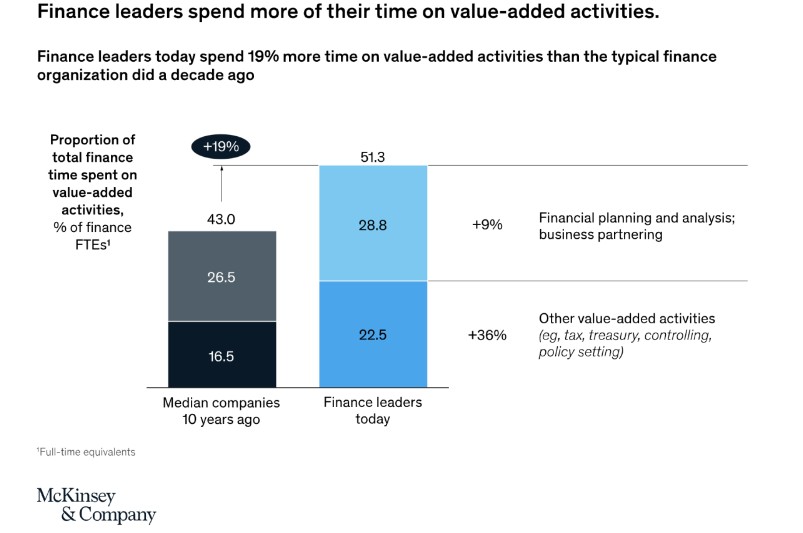

As organizations move toward xFP&A, CFOs, and finance teams are being asked to step into more strategic roles. A 2020 report by McKinsey & Company indicated that more than half of finance leaders were already dedicating significant time to forward-looking, value-added activities like analysis and planning. This number is expected to grow as businesses increasingly demand proactive insights from their finance departments. The introduction of generative AI and other advanced technologies has further accelerated this trend, making it essential for finance professionals to embrace continuous learning and reskilling. By keeping up with the latest innovations in data analysis, AI, and automation, finance teams can remain agile in today’s fast-paced economic climate.

McKinsey’s 2024 update to their findings emphasizes the importance of investing in data quality and upskilling finance staff to keep pace with technological advancements like AI. Finance leaders must ensure that their teams have access to accurate, comprehensive data in order to provide clear insights that guide business decisions effectively.

“As we fast approach the midpoint in that decade, several trends impacting finance professionals have emerged—not least the arrival of generative AI—highlighting a need for reskilling and upskilling finance professionals to be able to respond to the fast-moving macroeconomic context,” the authors wrote. “It is more important than ever for organizations to achieve a renewed focus on ensuring high-quality data, reinvestments in finance staff capability building, and developing more fluid working models to capture the promise of technologies such as GenAI that have occurred since the article was first published.”

Authors Ankur Agrawal, Steven Eklund, Josh Waite, and Ed Woodcock said finance departments need to be able to provide clearer, faster, and richer insights to be effective. This means access to up-to-date data, performance metrics, and holistic views of macroeconomic influences to quickly and appropriately assess and act in the company’s best interest.

Expanding Beyond Traditional Boundaries

In recent years, analysts at Gartner have highlighted a major shift in the role of finance in organizations, predicting that by 2024, a significant portion of FP&A projects will evolve into xFP&A initiatives. This evolution sees the finance function becoming more integrated with other business areas, taking on a larger, more comprehensive role in planning and analysis.

Gartner’s recommendations for finance leaders emphasize a move toward organization-wide planning that maximizes business impact. Implementing xFP&A enables finance teams to extend their influence beyond budgeting and forecasting, bringing added value to areas like supply chain management, operations, and human resources. By adopting digital tools such as AI and machine learning, companies can unlock richer insights and more accurate forecasts, enhancing their ability to react swiftly to market changes.

Adopting xFP&A in Your Organization

Transitioning to an xFP&A framework may sound like a complex task, but the benefits far outweigh the challenges. Take the case of a nonprofit organization struggling to align its financial goals with its mission. A finance director using a manual system for budgeting and tracking expenditures might find it difficult to consolidate data from multiple sources, making it tough to provide accurate reports to stakeholders or to optimize operations. However, by integrating an xFP&A solution, this nonprofit could consolidate its data into a single, centralized platform, allowing the finance team to gain better visibility into its financial health and future planning.

This consolidated data enables the organization to create customized key performance indicators (KPIs), track funding streams, and report accurately to its board of directors. The ability to align financial performance with mission-critical goals allows the nonprofit to position itself better when applying for grants and funding.

Drive Intelligent Decisions With Acumatica Integration

Solver is proud to be a Certified Acumatica application designed for planning, reporting, and analysis. Leveraging patented QuickStart integration technology to enable immediate access to ready-to-use reporting and planning templates. These templates allow you to quickly visualize your Acumatica data, facilitating accelerated and informed decision-making. Being integrated allows Acumatica users to access a robust ecosystem of business solutions to benefit your entire organization.

Elevate Your Performance with Solver’s xFP&A Solutions

Solver offers a state-of-the-art xFP&A solution designed to streamline your business’s financial planning and analysis efforts. Their integrated software allows organizations to optimize performance through automated workflows, advanced analytics, and real-time data insights. To learn more about how Solver can support your organization’s transition to xFP&A, contact their experts for a consultation or product demonstration today.