If your business uses Acumatica to manage operations, you already know how much sensitive data flows through the system, especially when it comes to payment processing. But have you ever stopped to ask if your Acumatica payment provider is PCI validated?

In simple terms, PCI validation means your payment processor meets the security standards required to handle credit card data safely. And if you’re processing payments through Acumatica ERP, this isn’t something to take lightly. Whether you’re in accounting, IT, or operations, understanding what PCI compliance means—and how it applies to your Acumatica integration—is critical to protecting your business.

What Is PCI Validation?

Payment Card Industry Data Security Standards (PCI DSS) refers to the security standards established by major credit card companies to protect cardholder data.

When people ask, “What is PCI compliance?” they’re usually talking about meeting the PCI DSS requirements. But PCI validation goes a step further. It means your payment processor has formally demonstrated compliance through audits or self-assessments, depending on their size and transaction volume.

There are different ways a provider can validate their compliance, including Self-Assessment Questionnaires (SAQs) and Reports on Compliance (ROCs). Regardless of the method, the result should be clear: the provider is PCI DSS compliant and meets all relevant PCI compliance requirements.

Why PCI Validation Matters in Acumatica

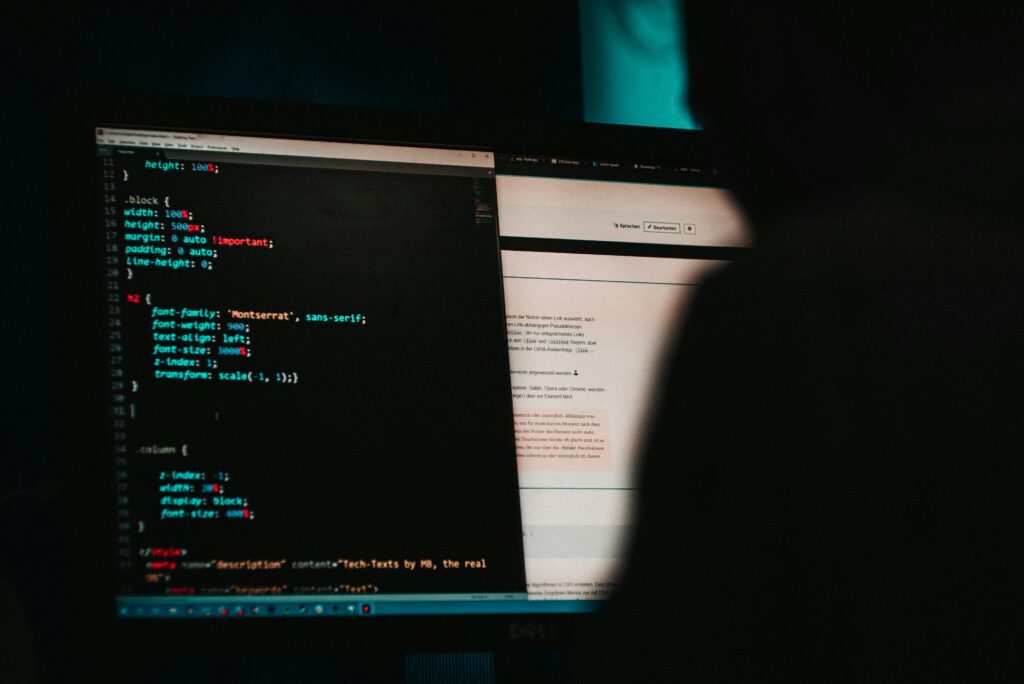

Acumatica ERP helps businesses centralize operations, but it doesn’t handle credit card processing on its own. That’s where third-party payment processors come in. These integrations handle the actual movement of funds—and potentially sensitive credit card information—making their PCI status especially important.

When using an Acumatica integration for payment processing, you need to know that your provider is more than just functional. They must be secure. Working with a provider that isn’t PCI compliant can expose your business to unnecessary risks: data breaches, fines, lost customer trust, and even disruptions to your operations.

The consequences of failing to meet PCI DSS compliance requirements can be severe. In the event of a data breach, your business may be subject to significant fines from credit card networks and regulatory bodies. You could also face increased transaction fees, mandatory security audits, or even the suspension of your ability to process payments. Beyond the financial implications, non-compliance can lead to reputational damage that affects customer retention and long-term trust.

Imagine, for example, a small eCommerce business using an unvalidated payment integration. After a breach exposes hundreds of customers’ credit card details, the company is hit with costly fines and has its payment capabilities suspended while undergoing a full audit. While larger businesses may be able to handle such a setback, it can be significantly more difficult for smaller businesses to recover. It can take months to restore operations, and even longer to regain their customers’ trust.

If you’re serious about keeping your customers’ data safe and avoiding compliance headaches, PCI validation should be non-negotiable.

How to Check If Your Provider Is PCI Validated

Knowing that your payment provider is PCI validated is one thing, but confirming it is another. While many providers claim to be “PCI compliant,” it’s important to verify that they’ve gone through the appropriate validation process. This step helps protect your business and ensures that your Acumatica integration is built on a secure, accountable infrastructure.

The good news is, checking a provider’s PCI status isn’t complicated. You can start by visiting the PCI Security Standards Council (PCI SSC) website and searching their list of validated service providers. This list is maintained and updated regularly, making it a reliable source of truth. If your Acumatica payment processor isn’t on that list, it may not meet all the necessary requirements, but it’s worth digging deeper.

Ask the provider directly for their Attestation of Compliance (AOC). A validated provider should be able to share documentation proving they meet PCI compliance requirements. This AOC outlines what services are covered and to what extent. If they’re hesitant or provide vague answers, that’s a red flag, especially for businesses that rely on Acumatica ERP to manage financial and customer data.

You should also consider how clearly they define their role in your PCI scope. A solid provider will offer transparency, help reduce your compliance workload, and support you with documentation, technical standards, and best practices. They should be a resource, not a risk.

What to Expect from a PCI Validated Provider

Choosing a PCI validated payment processor isn’t just about checking a box—it’s about building a relationship with a provider who truly understands the security needs of your business. When working within Acumatica ERP, you’re relying on an integrated system that handles everything from customer billing to financial reporting. That means your payment processing partner needs to meet the same high standards.

So, what should you expect from a PCI validated provider?

- Transparency: They should be upfront about their security practices, validation status, and how their systems integrate with Acumatica.

- Proper Documentation: A PCI DSS compliant provider should readily provide documentation such as an Attestation of Compliance (AOC) or proof of audit.

- Strong Encryption: Credit card data should be encrypted during transit and at rest using industry-standard protocols.

- Tokenization: Sensitive card data should be replaced with tokens, limiting exposure in your environment.

- Role-Based Access Controls: Only authorized users should have access to payment functions and credit card information.

- Detailed Audit Logs: You should be able to track who accessed what data and when.

- Support with PCI Compliance Requirements: A validated provider often reduces your PCI scope, making meeting your own obligations easier.

Ultimately, a trustworthy, PCI validated payment processor not only reduces your risk but also simplifies the compliance process, making for a more secure and seamless Acumatica integration.

EBizCharge: A PCI validated solution for Acumatica

If you’re looking for an Acumatica integration that simplifies all of this, EBizCharge serves as a top-rated solution. It’s a PCI validated payment processing solution built specifically for Acumatica users.

EBizCharge embeds directly into Acumatica, which keeps sensitive credit card data from ever touching your local environment. This embedded design not only improves security, but also reduces the business’s PCI scope and shortens the checklist during audits, especially helpful for smaller finance teams managing multiple responsibilities. This not only makes your setup more secure, but also drastically reduces your PCI DSS compliance scope.

EBizCharge supports all the essentials—secure tokenization, encryption, audit logging, etc.—and provides the documentation you need to prove you’re working with a PCI DSS compliant provider.

If you’re handling a high volume of credit card processing in Acumatica, having a tool like EBizCharge in place can bring serious peace of mind.