Preparing for Significant Year-End Forms Changes for 2025

As we move into 2025, significant changes in reporting thresholds, federal e-filing requirements, and new form updates make it essential to stay ahead of compliance. With Greenshades paired with Acumatica, you can simplify these processes, maintain accuracy, and reduce administrative burdens.

Here’s what you need to know about the latest changes and how Greenshades supports your Year-End Forms (YEF) needs.

Key Year-End Form Changes for 2025

1099-K Threshold Adjustments

- 2024 Reporting Threshold: Payments exceeding $5,000 in settlement of third-party network transactions must be reported.

- 2025 Reporting Threshold: This threshold decreases to $2,500, meaning more transactions will require reporting.

- 2026 and Beyond: The threshold drops significantly to $600, impacting most third-party network payments.

This progressive decrease in thresholds means businesses must have a 1099 filing system in place to track and report smaller transactions accurately.

Cumulative Filing Requirements

Starting in 2024, the federal e-filing threshold applies cumulatively across all return types, including W-2s, 1099s, and ACA forms. The previous 250-form limit has been reduced to just 10 forms, making e-filing a requirement for most businesses.

State-Specific Reporting

States may adopt similar thresholds or introduce unique e-filing rules. For example, while the IRS thresholds change, some states might still enforce their own requirements, requiring businesses to stay informed about their specific state tax obligations.

1099-MISC and W-2 Updates

- 1099-MISC: Box 14 for reporting Excess Golden Parachute Payments remains in use for 2024 filings.

- W-2 Updates: Box 12 introduces Code II to report Medicaid waiver payments excluded from gross income, ensuring better clarity and compliance with Notice 2014-7.

Employee Notices for Refundable Tax Credits

Certain states, including California, Colorado, Illinois, Maryland, New Jersey, and Oregon, require employers to notify employees about refundable tax credits, adding another layer of compliance for businesses operating in multiple jurisdictions.

What’s your year-end form process look like? Are you using tools to make it easier and error-proof? We admit, we’re a little biased, since we offer a solution that helps businesses comply with ever-changing regulations without worry. But our goal here is to make you aware of what has changed, and to help you get in front of these data burdens before they become issues, or worse, expensive lessons.

Have a Year-End Forms question for our team? Let us know – [what’s the best way to do that]?

How Greenshades Simplifies Year-End Forms Filing

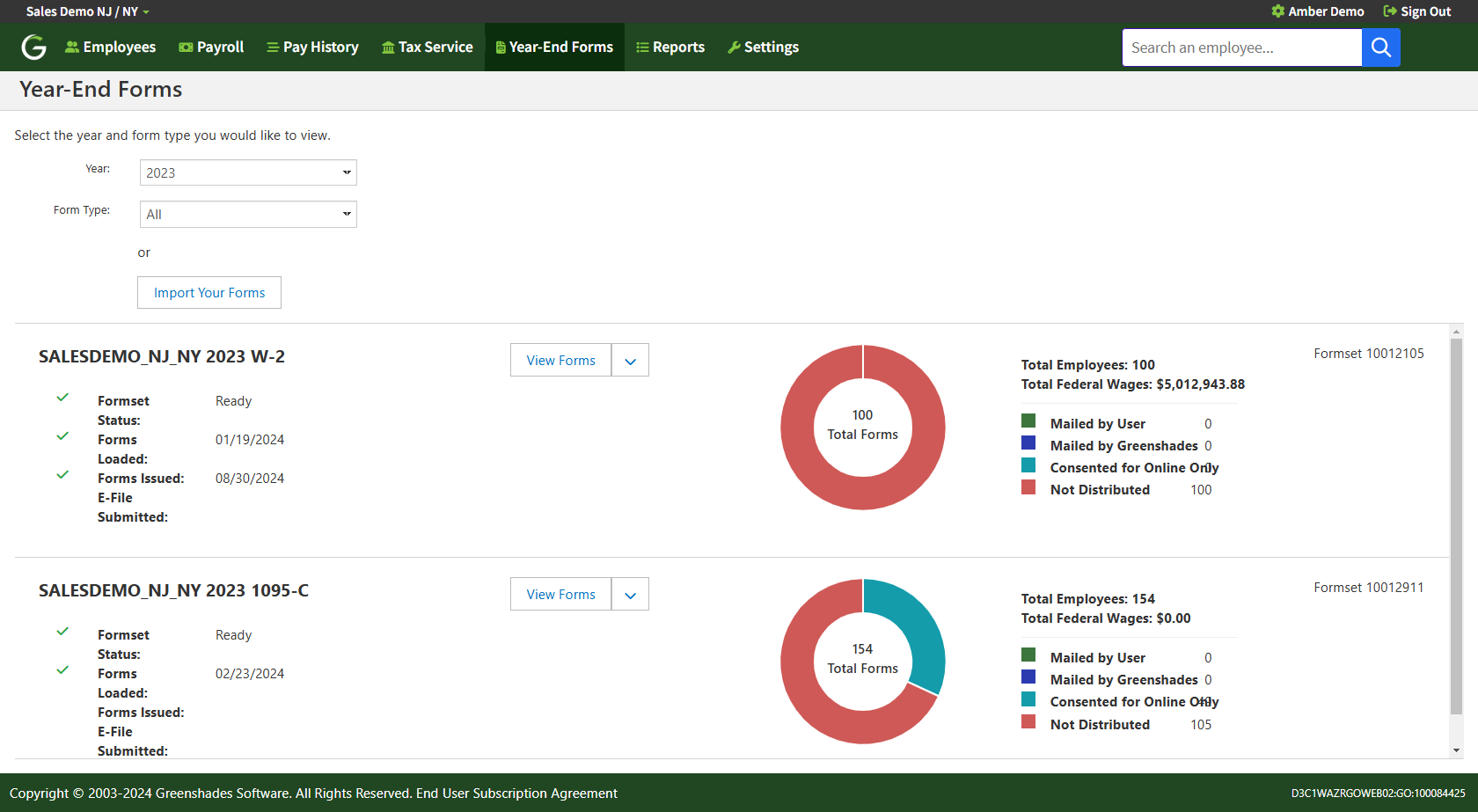

Greenshades integrates with Acumatica, providing a comprehensive solution for handling year-end forms with ease and accuracy. At the core of this offering is the Year-End Forms Portal, a centralized dashboard that provides complete visibility into all your forms, including W-2s, 1099s, and ACA filings.

- Automated validation tools to flag common issues, such as mismatched Social Security numbers or incomplete fields. With an intuitive interface, you can easily edit and validate forms before submission.

- Flexible options for filing, e-file directly with federal and state agencies, e-file using Greenshades, or utilize the print-and-mail service to distribute forms to employees.

- Simple access for employees to year-end forms through the Employee Self-Service Portal. Additionally, Greenshades integrates with tax preparation platforms like TurboTax, enabling employees to securely upload their year-end information directly into their tax software.

Why Greenshades and Acumatica Are the Perfect Pair for YEF

By combining Greenshades’ expertise in payroll, HR, and tax compliance with Acumatica’s robust ERP capabilities, businesses gain a powerful solution to manage year-end reporting seamlessly. This integration ensures accurate data flow, reduces administrative workloads, and supports compliance with evolving thresholds and regulations.

Take the Stress Out of Year-End Filing

As 2025 ushers in significant changes to YEF requirements, now is the time to prepare. Greenshades simplifies year-end reporting, ensures compliance, and integrates seamlessly with Acumatica to make your year-end tasks easier than ever.

Ready to streamline your YEF process? Schedule a demo today and see how Greenshades can help you stay compliant and efficient in 2025 and beyond!